Hello Everyone, If you are a Central or State Government employee, or a pensioner, there’s good news for you in 2025. The Government has officially increased the Dearness Allowance (DA) rate, which means more money in your pocket every month. This change doesn’t just affect your DA—it can also increase other allowances linked to it. In this article, we’ll break down the new DA rates, how the hike will be calculated, the benefits you’ll get, and who exactly stands to gain from this announcement.

Understanding Dearness Allowance

DA is basically an extra amount that the Government adds to your salary or pension so you can cope with rising prices. Every six months—January and July—it’s revised based on the Consumer Price Index (CPI). For employees, it’s calculated on the basic pay, and for pensioners, on the basic pension. This way, even if inflation eats into your income, the DA helps you keep up with living costs. And yes, DA is taxable, just like the rest of your salary.

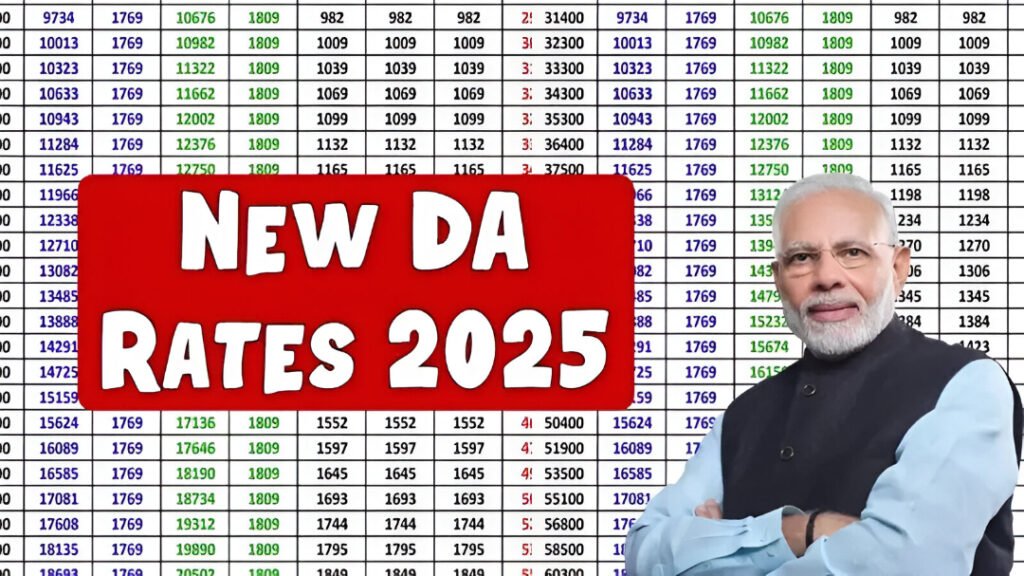

New DA Rates for January 2025

From 1st January 2025, the DA has gone up by 4%, making it a neat 50% of your basic pay. This is a milestone because hitting the 50% mark triggers other allowance revisions under the 7th Pay Commission. Whether you’re a serving employee or a pensioner, this hike directly increases your monthly earnings. Plus, the arrears for the months before the official notification will be credited soon—so expect a lump sum in your account.

How DA is Calculated

The DA hike isn’t just pulled out of thin air; it’s worked out using a proper formula:

DA% = (Average CPI of last 12 months – Base Index) × 100 / Base Index

-

CPI figures are taken from the Labour Bureau every month

-

The average for the last 12 months is used

-

The “Base Index” changes depending on whether you’re under the 5th, 6th, or 7th Pay Commission

This calculation ensures that DA reflects the real impact of inflation on employees’ pockets.

Impact on Basic Pay & Allowances

A DA of 50% means more than just a higher monthly salary—it also bumps up other perks:

-

House Rent Allowance (HRA) for employees in X, Y, Z cities

-

Transport Allowance for daily travel

-

Special Duty Allowances in certain sectors

-

Pension and family pension amounts

This is why government employees and pensioners look forward to DA announcements every six months.

Salary Hike Example

Let’s say your basic pay is ₹50,000 per month.

-

Old DA @ 46% = ₹23,000

-

New DA @ 50% = ₹25,000

-

Difference = ₹2,000 more every month (₹24,000 a year)

And remember—this doesn’t even include the HRA, transport, and other allowance hikes that come with hitting the 50% DA milestone.

Who Benefits from DA Hike

The good news isn’t just for Central Government employees. Here’s who gets the benefit:

-

Central Government staff under various ministries

-

State Government employees (where states adopt the new rate)

-

PSU employees following Government pay structures

-

Pensioners and family pensioners

-

Autonomous body employees on Government pay scales

If you fall into any of these categories, the DA hike applies to you.

Allowances Revised After 50% DA

Once the DA touches 50%, several allowances get an automatic upgrade:

-

Children Education Allowance goes up by 25%

-

Uniform and Washing Allowances increase

-

Daily Allowance on tours and transfers is revised

-

Special Compensatory Allowances for certain areas rise

-

Cash Handling Allowance for specific jobs also sees a hike

These small changes, when added up, make a noticeable difference in your monthly budget.

Benefits for Pensioners

For pensioners, the DA hike is a blessing. Since it’s applied to the basic pension, even retired employees see an instant increase in their monthly pension. Family pensioners get the same percentage hike, and arrears will be paid from January 2025. In times of rising healthcare and daily expenses, this increase offers much-needed relief.

FAQs on New DA Rates 2025

Q1. What’s the new DA rate from January 2025?

It’s now 50%, up from 46%.

Q2. Who decides the DA percentage?

The Central Government, based on CPI data.

Q3. Will my HRA go up with the DA hike?

Yes, certain allowances, including HRA, increase when DA hits 50%.

Q4. Do pensioners get the same DA hike?

Yes, pensioners and family pensioners get the same percentage hike.

Q5. How often is DA revised?

Twice a year—January and July.

Q6. Is DA taxable?

Yes, it’s fully taxable as part of your salary or pension.

Q7. Will I get arrears for previous months?

Yes, arrears are paid along with the revised DA.

Conclusion

The jump to 50% DA in 2025 is a big win for government employees and pensioners. Along with boosting monthly earnings, it brings higher allowances and arrears, giving a much-needed cushion against rising costs. This is one of those updates that genuinely makes a difference in everyday life.

Disclaimer : This article is for information purposes only, based on official Government announcements available at the time of writing. For exact pay calculations, employees and pensioners should refer to the official notification or speak with their HR or accounts department.